Diversifying with Cryptocurrencies: Risk or Reward?

12 April 2025

Ah, diversification—the magic word that makes you feel like a responsible investor. Spreading your investments across various assets is the golden rule of finance, right? Stocks, bonds, real estate… and, oh yes, let’s not forget the wild, unpredictable, and downright rebellious world of cryptocurrencies.

But here’s the golden question: Is adding crypto to your portfolio a genius move or just a fast track to financial heartbreak? Let’s unpack this mess together.

The Case for Diversification

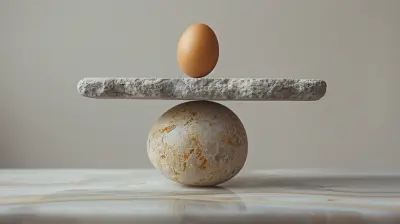

We’ve all heard the advice: “Don’t put all your eggs in one basket.” That’s Portfolio Management 101. Traditional assets might provide steady growth, but they can also be dragged down by economic downturns, political drama, and—let’s be honest—human stupidity.Crypto, however, runs to its own beat. It doesn’t care about traditional markets, central banks, or whether your boring blue-chip stocks are taking a day off. Could this independence make it the ultimate diversification tool? Maybe. Or maybe it’s just another financial rollercoaster waiting to ruin your lunch.

The Reward: Why Crypto Could Be a Smart Diversification Move

1. Non-Correlation to Traditional Markets

Most traditional assets—stocks, bonds, real estate—dance to the same predictable tune. When the economy is strong, they rise; when a recession kicks in, they flop. Simple.Crypto, however, is that one friend who refuses to follow the rules. While stock markets crash due to inflation or geopolitical events, Bitcoin might decide to moon out of nowhere. A perfect hedge? Well, not always, but it's definitely not moving in sync with your dad’s retirement fund.

2. Insane Growth Potential

If you invested $1,000 in Bitcoin back in 2010, you’d be sipping cocktails on your private island by now. Cryptocurrencies have an unparalleled growth trajectory—assuming you pick the right ones and don’t fall for scams (looking at you, Squid Coin).There’s no denying that some cryptos offer astronomical returns. Unlike your 5% annual return on an index fund, crypto can 10x overnight. But, as with anything too good to be true, there’s a catch.

3. A Hedge Against Inflation? (Sort of, Maybe, Who Knows?)

Crypto enthusiasts love to sell Bitcoin as the ultimate inflation hedge. The argument? Bitcoin has a fixed supply of 21 million coins, unlike fiat money, which central banks print like Monopoly money.Sounds great in theory. In reality? Let’s just say crypto has had its fair share of inflation-sinking moments. It’s a hedge when it wants to be—but don’t count on it the way you’d count on grandma’s secret cookie recipe.

The Risk: Why Crypto Might Wreck Your Portfolio

1. Volatility That’ll Give You Whiplash

If stock market volatility stresses you out, then crypto is going to send you straight into cardiac arrest. It’s not just volatile—it’s volatility on steroids.One minute, Bitcoin is soaring, making you feel like the next Warren Buffett. The next, it’s tanking 30% because Elon Musk felt like tweeting. If you have a weak stomach, you might want to sit this one out.

2. Regulation Nightmares

Governments love to pretend they embrace innovation—until they realize they can’t control it.Crypto regulations are about as predictable as a soap opera. One day, China is banning crypto. The next, the U.S. SEC is waving lawsuits around like confetti. Will crypto eventually be fully regulated? Probably. Will that be good or bad for investors? Your guess is as good as mine.

3. Scams, Hacks, and Rug Pulls—Oh My!

Sure, crypto is decentralized—but that also means there’s no FDIC insurance, customer support, or “Oops, I got hacked” refund policies.From shady exchanges vanishing overnight to pump-and-dump schemes disguised as the “next big thing,” the crypto space is riddled with pitfalls. If you’re thinking of investing, do your homework, or get ready to kiss your hard-earned money goodbye.

So… Should You Diversify with Crypto or Not?

Like most things in finance, the answer is it depends.- If you’re risk-averse and panic at the sight of red numbers, stick to traditional investments.

- If you’re willing to stomach extreme volatility and hold for the long run, adding a small percentage of crypto might actually work in your favor.

The key is balance. Throwing half your portfolio into Dogecoin because your cousin made $10,000 overnight is not diversification—it’s gambling.

Instead, consider allocating 1-5% of your portfolio to quality cryptos like Bitcoin and Ethereum (you know, the ones that have survived more than a few market cycles). That way, if crypto goes to the moon, you win. If it crashes and burns, you don’t lose your house.

Final Thoughts

Cryptocurrency is the rebellious teenager of the financial world—unpredictable, chaotic, and occasionally brilliant. Is it a game-changing asset class or just another bubble waiting to pop? Probably both.Diversifying with crypto is not for the faint-hearted. But if done wisely, it could inject some serious potential into your portfolio. Just remember: Never invest more than you’re willing to lose, be ready for turbulence, and—above all—enjoy the ride.

all images in this post were generated using AI tools

Category:

Portfolio DiversificationAuthor:

Harlan Wallace

Discussion

rate this article

6 comments

Kayla Mahoney

This article compellingly outlines the dual nature of cryptocurrency investment. While diversification can enhance potential rewards, the inherent volatility and regulatory uncertainties pose significant risks. A balanced approach is crucial for informed decision-making in this evolving landscape.

April 29, 2025 at 8:54 PM

Harlan Wallace

Thank you for your insight! Balancing the potential rewards of diversification with the risks of volatility and regulation is indeed essential for navigating the cryptocurrency landscape wisely.

Audra McCall

Carefully assess risks; cryptocurrencies can enhance portfolio diversification.

April 21, 2025 at 4:40 AM

Harlan Wallace

Absolutely! While cryptocurrencies can offer diversification benefits, it’s crucial to thoroughly evaluate the risks involved before incorporating them into your portfolio.

Monica Hodge

Cryptocurrencies offer high potential rewards, but volatility poses significant risks for investors.

April 20, 2025 at 4:29 AM

Harlan Wallace

You're absolutely right; while cryptocurrencies can yield substantial returns, their inherent volatility can lead to significant losses. It's crucial for investors to weigh these risks carefully when considering diversification.

Caitlin Adams

Great insights! Balancing risk and reward in crypto can be tricky but worth exploring for a diverse portfolio.

April 18, 2025 at 10:28 AM

Harlan Wallace

Thank you! Absolutely, finding the right balance is key to maximizing potential in a diverse portfolio.

Adrian Potter

Great article! It’s crucial to weigh the potential rewards of cryptocurrency diversification against the inherent risks. Consider starting with a small allocation, and always stay informed about market trends.

April 14, 2025 at 6:45 PM

Harlan Wallace

Thank you for your thoughtful comment! Balancing risks and rewards is indeed essential when diversifying with cryptocurrencies. Staying informed is key.

Thaddeus McNaughton

Great insights! Balancing potential rewards with the inherent risks of cryptocurrencies is crucial for any diversified investment strategy. Thank you!

April 14, 2025 at 11:50 AM

Harlan Wallace

Thank you for your feedback! Balancing risks and rewards is indeed key in cryptocurrency investment.

MORE POSTS

Timing the Market vs. Time in the Market: Which Strategy is Best?

Uncovering the Best Dividend Stocks for Long-Term Investment

Insider Buys vs. Insider Sells: What They Mean for Stock Prices

Investing for Beginners: What You Need to Know to Get Started

How to Balance Retirement Savings and Other Financial Goals