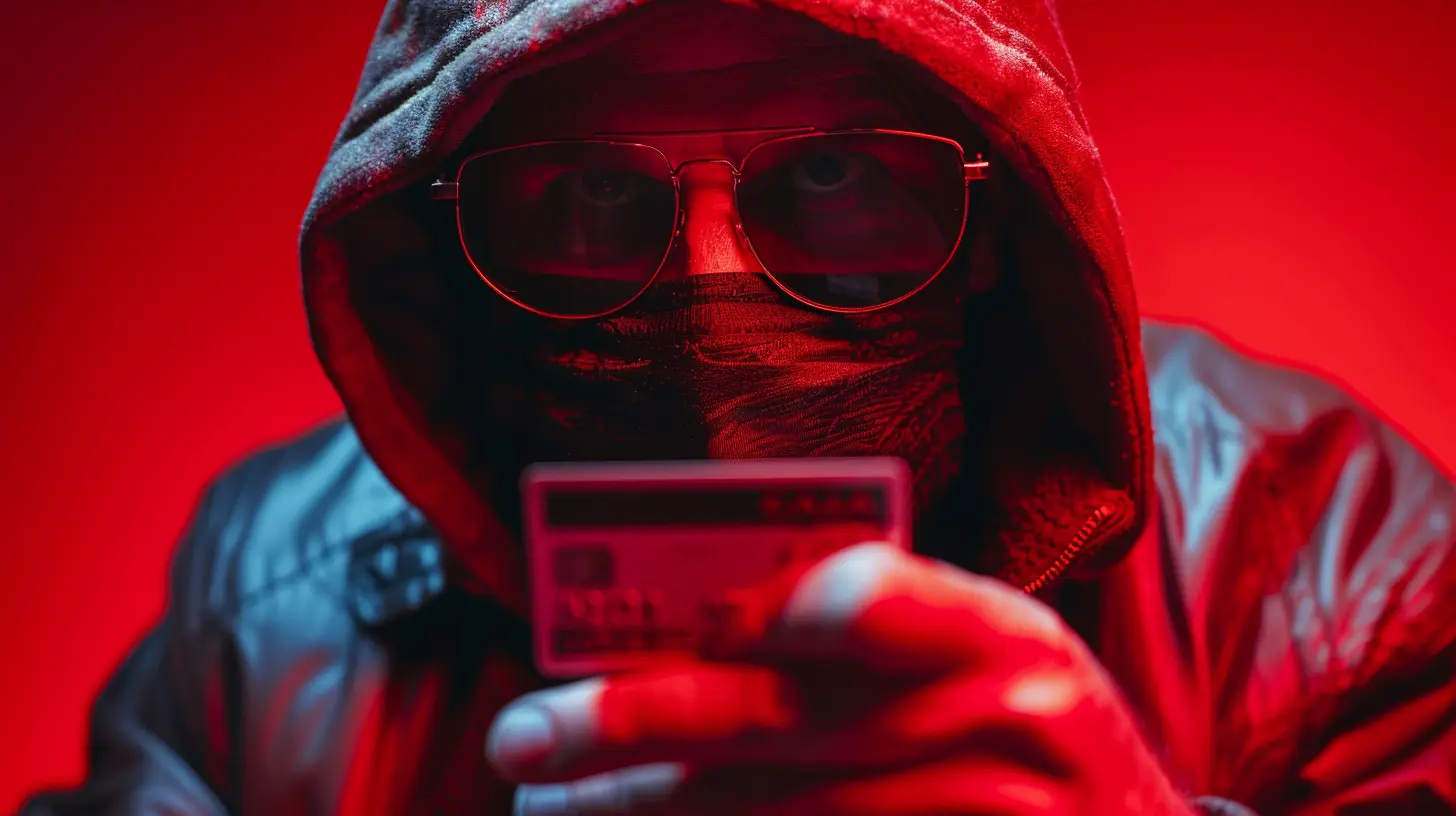

How to Avoid Credit Card Scams and Phishing Schemes

20 April 2025

Credit cards are a convenient way to shop, pay bills, and even build your credit score. But with that convenience also comes risk—scammers are always looking for new ways to steal your information and money. If you're not careful, you could find yourself falling victim to a credit card scam or phishing scheme, which could leave you financially drained and stressed out.

The good news? You don’t have to be a cybersecurity expert to protect yourself. By understanding how these scams work and knowing the warning signs, you can avoid being tricked. Let's dive into some of the most common credit card scams and phishing schemes, along with practical tips to keep your finances safe.

What Are Credit Card Scams and Phishing Schemes?

Before we get into how to prevent these scams, it's important to understand what they are.Credit Card Scams

A credit card scam is any fraudulent activity that involves stealing credit card information to make unauthorized purchases or withdrawals. Scammers use various tricks, from card skimming devices to online fraud, to trick people into giving up their card details.Phishing Schemes

Phishing is a type of cyber scam where fraudsters impersonate legitimate businesses or individuals to steal sensitive information. It often comes in the form of fake emails, text messages, or phone calls that try to trick you into revealing your credit card number, PIN, or password.Now that we know what we're dealing with, let’s look at some of the most common scams and how you can steer clear of them.

Common Types of Credit Card Scams and Phishing Schemes

Scammers are getting smarter every day, but their tactics often follow similar patterns. Here are some of the most common ones to watch out for:1. Fake Fraud Alerts

You get a call or text claiming to be from your bank, warning you about suspicious activity on your credit card. The scammer then asks you to confirm your credit card number or provide your security code.How to Avoid It:

- Never share your credit card details over the phone unless you initiated the call.

- If you're unsure, hang up and call the official customer service number on the back of your card.

2. Phishing Emails and Texts

You receive an email or text from what looks like your bank, PayPal, or another financial institution. It asks you to click a link and enter your login details or credit card information.Signs of a Phishing Email:

- Urgent language (e.g., “Your account has been compromised! Act now!”)

- Suspicious sender address (e.g., [email protected] instead of paypal.com)

- Poor grammar and misspellings

- A link that looks legitimate but redirects to a fake website

How to Avoid It:

- Never click on links in unsolicited emails or texts.

- Always type the website’s address directly into your browser instead.

- Verify emails with your bank before taking any action.

3. Card Skimming Devices

Scammers install tiny devices on ATMs or gas station card readers that steal your card details when you swipe. Some also use hidden cameras to capture your PIN.How to Avoid It:

- Check for loose or unusual parts on card readers before inserting your card.

- Use contactless payment methods when possible to reduce swiping risks.

- Cover the keypad with your hand while entering your PIN.

4. Fake Customer Support Calls

A scammer calls pretending to be customer support from your credit card company. They claim there’s an issue with your account and ask for your personal details to "fix" it.How to Avoid It:

- Legitimate customer support teams will never ask for your full credit card number or PIN over the phone.

- If in doubt, hang up and call your bank’s official number.

5. Free Trial Scams

Some online offers claim to give you a free product or service but ask for your credit card details for "shipping fees." Later, they charge you hidden monthly fees, and canceling can be difficult.How to Avoid It:

- Read the terms and conditions before signing up for any free trial.

- Use virtual or prepaid cards for online purchases when possible.

6. Overpayment Scams

A scammer overpays for something you’re selling online and asks you to refund the extra amount. The payment they sent is usually fraudulent, and you’ll end up losing your money.How to Avoid It:

- Never accept overpayments or refunds for online transactions.

- Wait for payments to clear before sending goods or money.

How to Protect Yourself from Credit Card Fraud

Scammers will always be around, but that doesn’t mean you have to fall for their tricks. Follow these tips to keep your credit card information safe:1. Monitor Your Statements Regularly

Check your credit card statements often to spot any unauthorized transactions. If something looks off, report it immediately.2. Enable Fraud Alerts

Many banks offer fraud alerts via text or email whenever suspicious activity is detected. Activate these alerts so you'll be notified instantly.3. Use Strong and Unique Passwords

If you use the same password for all your financial accounts, scammers only need to crack one to access everything. Use unique, complex passwords and consider a password manager to keep track of them.4. Don’t Save Your Card Info on Websites

It may be convenient, but storing your credit card details online increases the risk of them being stolen in a data breach. Instead, enter your card details manually each time or use a secure digital wallet.5. Avoid Public Wi-Fi for Transactions

Public Wi-Fi networks are often unsecured, making it easy for hackers to intercept your data. Avoid making online purchases or checking your bank account on public Wi-Fi.6. Use Virtual Cards for Online Payments

Many banks now offer virtual credit cards that generate a temporary number for online purchases. Even if a scammer steals these details, they won’t be able to use them long-term.7. Keep Your Contact Details Updated

Ensure your phone number and email are up-to-date with your bank so you can receive important security alerts.

What to Do If You Fall for a Scam

Even the most cautious people can fall victim to a scam. If you suspect you’ve been scammed, act quickly:1. Contact Your Bank Immediately – Report any unauthorized transactions and request a card replacement if needed.

2. Change Your Passwords – If your account credentials were stolen, update your passwords immediately.

3. Monitor Your Credit Report – Check for any fraudulent activity that could affect your credit score.

4. Report the Scam – Notify the appropriate authorities, such as the Federal Trade Commission (FTC) or your local fraud protection agency.

Final Thoughts

Credit card scams and phishing schemes can be scary, but with a little awareness and caution, you can keep your finances safe. Always trust your instincts—if something feels off, it probably is. By staying vigilant and following the steps outlined in this guide, you can avoid becoming a scammer’s next victim.Stay secure, stay smart, and protect your hard-earned money!

all images in this post were generated using AI tools

Category:

Credit CardsAuthor:

Harlan Wallace

Discussion

rate this article

6 comments

Fleur Kim

Stay vigilant and verify sources to protect your finances.

May 4, 2025 at 11:17 AM

Harlan Wallace

Absolutely! Staying informed and verifying information are crucial steps in safeguarding your finances. Thank you for your insight!

Sofia McIntosh

Stay vigilant and verify before sharing information.

April 28, 2025 at 4:53 AM

Harlan Wallace

Absolutely! Always double-check sources before sharing to protect yourself and others.

Marlowe Carey

Thank you for this informative article! It's so easy to overlook the signs of scams in our busy lives. I appreciate the practical tips you provided. Staying vigilant and informed is crucial, and this guide is a great reminder to always prioritize our financial safety. Keep up the great work!

April 24, 2025 at 8:13 PM

Harlan Wallace

Thank you for your kind words! I'm glad you found the tips helpful. Staying informed is key to protecting ourselves.

Jett Jenkins

Empower yourself with knowledge! Stay vigilant and proactive, and you'll outsmart scammers. Trust your instincts, safeguard your information, and take control of your financial future today!

April 23, 2025 at 4:43 AM

Harlan Wallace

Thank you for your insightful comment! Staying informed and proactive is indeed key to protecting against scams. Your tips are invaluable for safeguarding our financial futures!

Abigail McClintock

In shadows where deceit does creep, Guard your treasures, vigil keep. With wisdom's light, you’ll navigate— Secure your heart, don’t hesitate. Stay alert, let scams not bait.

April 22, 2025 at 2:41 AM

Harlan Wallace

Thank you for your poetic reminder! Staying vigilant and informed is key to protecting ourselves from scams.

Zephira Foster

In today’s digital age, vigilance is key. Regularly monitor your statements, use secure passwords, and be cautious with unsolicited emails. Educating yourself on common scams can significantly reduce the risk of falling victim. Stay informed!

April 20, 2025 at 10:38 AM

Harlan Wallace

Thank you for highlighting these essential tips! Staying vigilant and informed is crucial in protecting ourselves from scams.

MORE POSTS

Preparing for Capital Gains Liabilities When Selling a Business

Pension Plans and Taxes: How to Minimize Your Tax Burden

How to Handle Unexpected Expenses Without Wrecking Your Budget

Are You Saving Enough for Your Desired Retirement Lifestyle?

How to Build a Retirement Safety Net for Unexpected Expenses