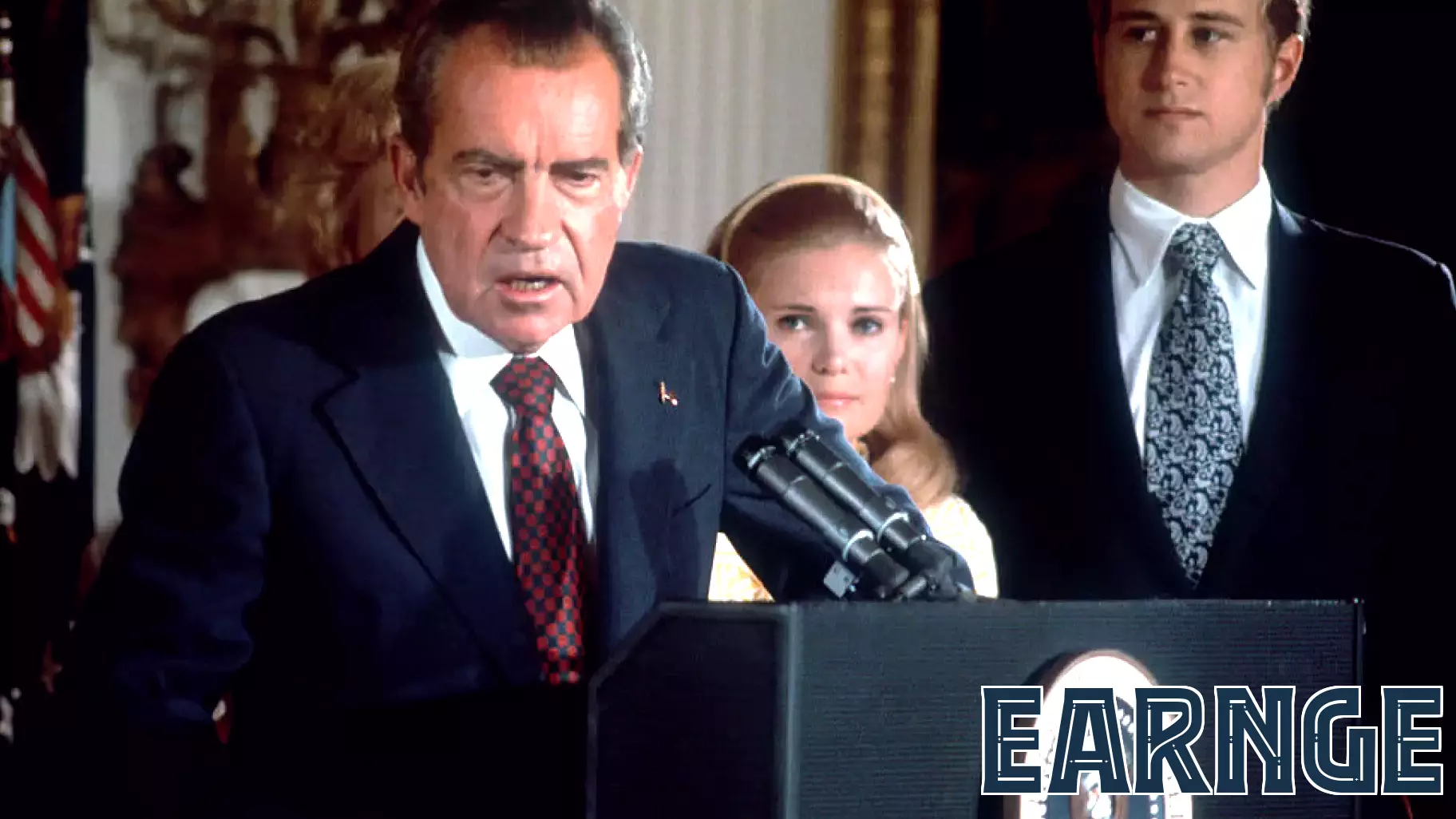

Analyzing Market Reactions to Nixon's Pressure on the Federal Reserve

August 26, 2025 - 23:14

Nomura conducted a retrospective analysis of the financial markets during President Nixon's campaign to influence the Federal Reserve in the early 1970s. This period was marked by significant economic challenges, including rising inflation and unemployment, which prompted Nixon to seek a more accommodative monetary policy.

As Nixon applied pressure on the Fed, the central bank faced a dilemma: maintain its independence or respond to the political climate. The analysis reveals that the markets reacted with volatility as investors grappled with uncertainty regarding monetary policy direction. Stock prices fluctuated, reflecting concerns about inflation and the potential for economic instability.

Bond yields also experienced notable shifts, as traders adjusted their expectations for interest rates in light of the Fed's potential response to political pressures. Overall, the historical examination underscores the intricate relationship between political influence and market behavior, highlighting the lasting implications of Nixon's actions on the financial landscape.

MORE NEWS

February 14, 2026 - 20:05

Service milestones in FebruaryClemson University recently paused to recognize and celebrate the profound contributions of its faculty and staff members who reached significant service milestones in February. The institution...

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...