Bond Market Influences Trump's Decision on Tariffs

April 11, 2025 - 12:49

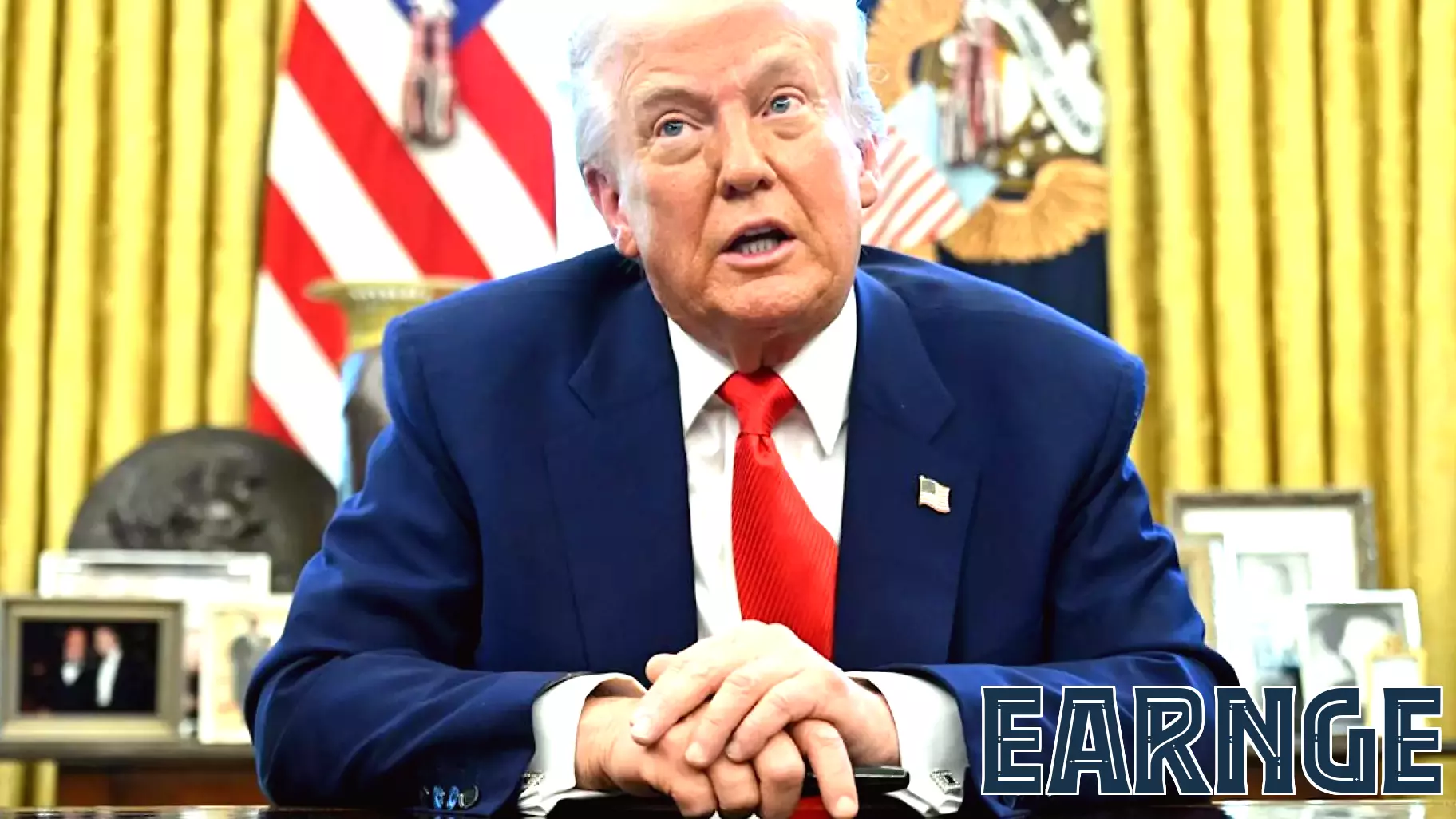

President Trump has decided to halt the implementation of reciprocal tariffs, a move influenced significantly by fluctuations in the bond market. This unexpected pause signals a shift in strategy as the administration navigates the complex landscape of international trade relations. Observers note that the bond market's response to potential tariffs created a ripple effect, prompting the president to reconsider his approach.

Trump's acknowledgment of the bond market's impact on his decision highlights the intricate relationship between financial markets and governmental policy. As bond yields reacted to the prospect of tariffs, concerns over economic stability and growth became more pronounced. The president's decision to "blink" reflects an awareness of the broader economic implications that could arise from escalating trade tensions.

This development raises questions about future tariff policies and the administration's willingness to adapt in response to market signals. As the situation unfolds, stakeholders will be closely monitoring how these dynamics influence both domestic and global economic landscapes.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...