Brazil Aims to Elevate Developing Nations' Voices at COP30 Amid U.S. Withdrawal from Paris Agreement

January 24, 2025 - 00:53

Brazil, the host of this year's COP30 global climate summit, is seizing the moment to enhance the representation of developing nations in climate financing discussions. This initiative comes in the wake of the United States' exit from the Paris Agreement, which has raised concerns about the global commitment to combat climate change.

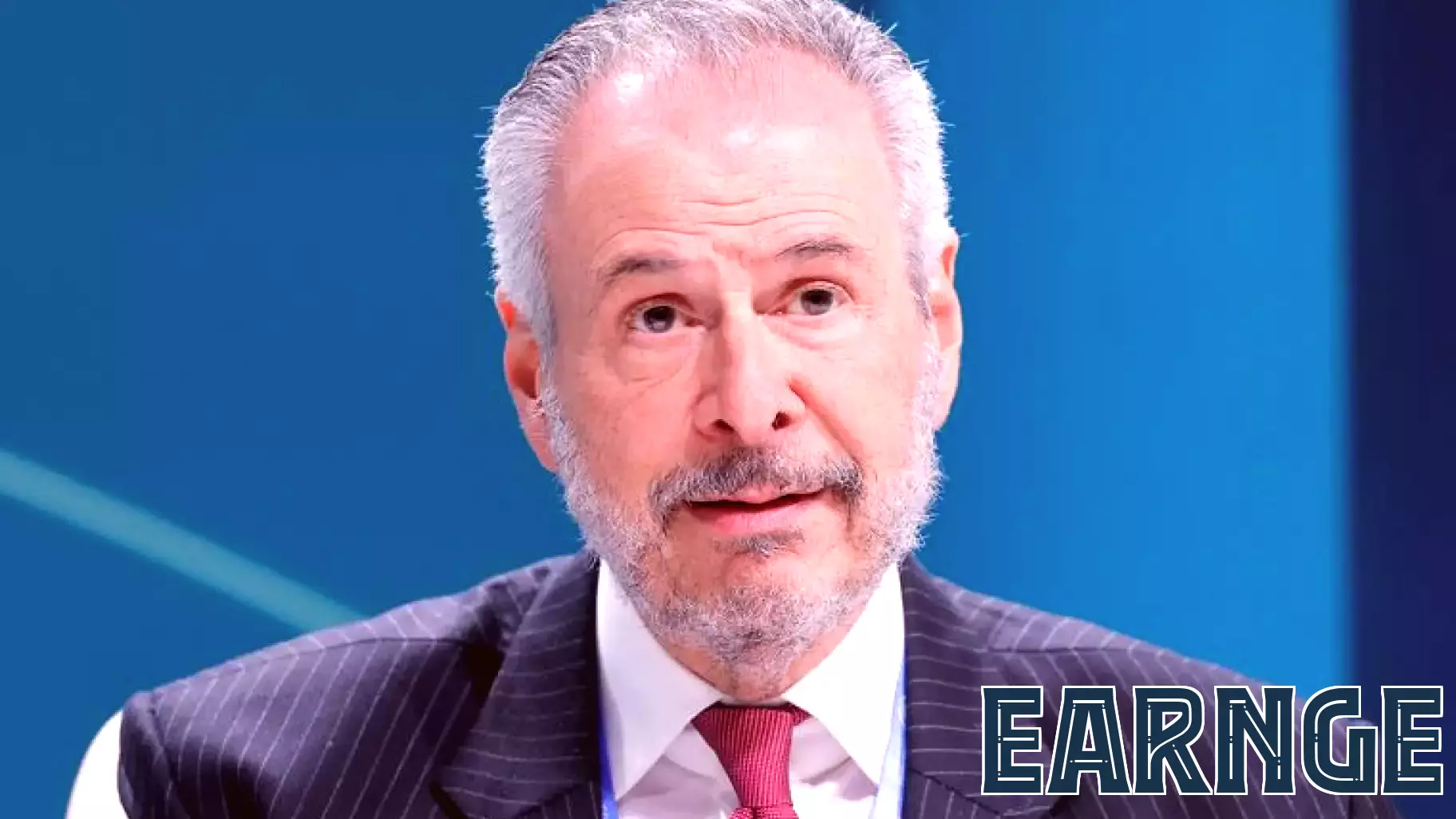

Andre Correa do Lago, the head of COP30, addressed journalists in Brasilia, emphasizing that negotiations are anticipated to be "harder" this year compared to the previous summit. He noted that last year's discussions benefited from U.S. participation, as the country was actively pursuing policies aimed at curbing climate change. The absence of the U.S. poses significant challenges, particularly regarding the fulfillment of climate finance targets that are crucial for supporting vulnerable nations in their climate resilience efforts.

As the summit approaches, Brazil is determined to ensure that the voices of developing countries are heard and prioritized in the ongoing dialogue about climate action and financial support.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...