China Braces for Economic Tensions with the U.S. Amid Yuan and Stock Market Concerns

January 17, 2025 - 07:53

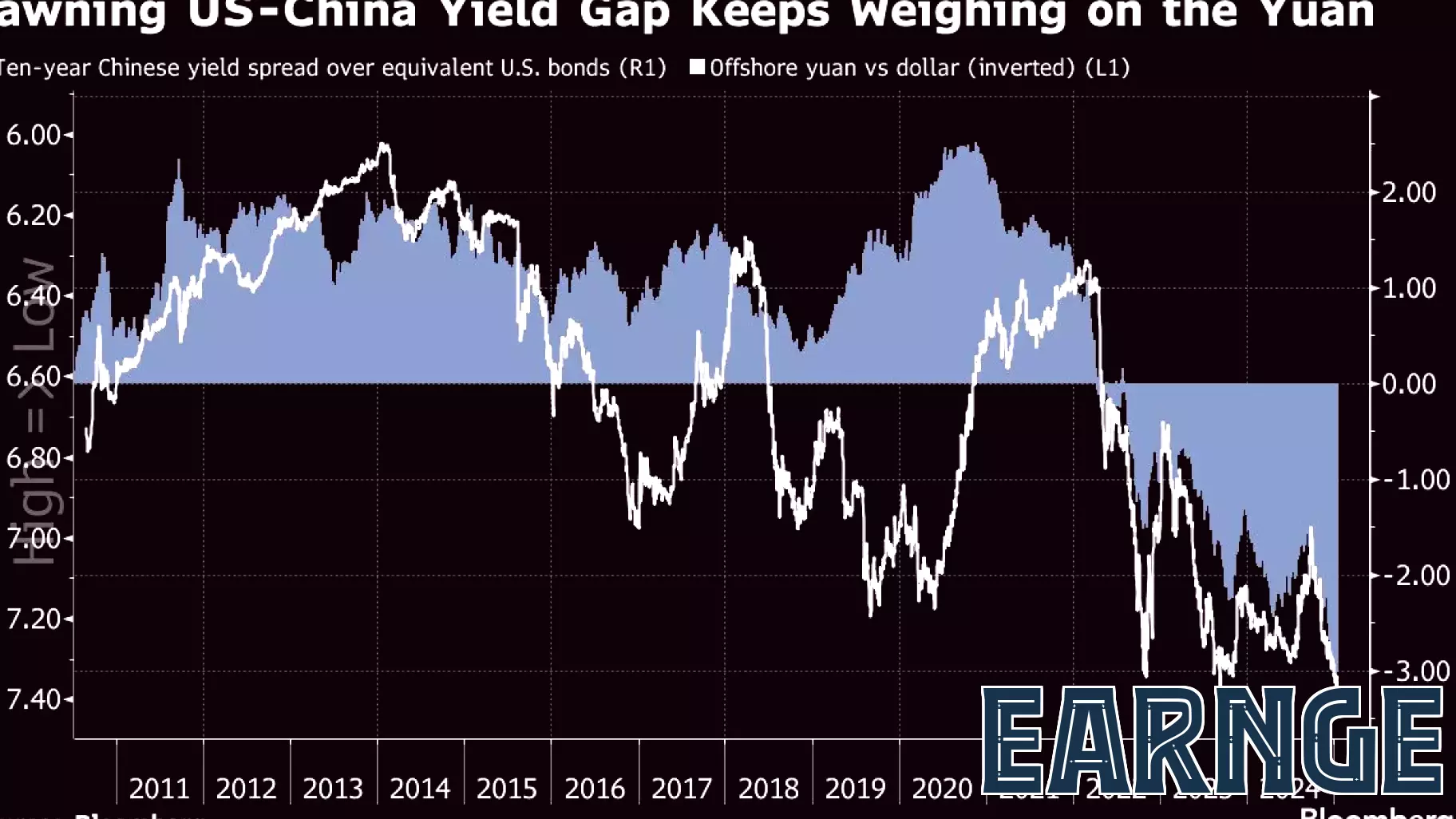

As tensions rise between China and the United States, investors in China are preparing for another round of economic challenges reminiscent of previous trade wars. The current climate is fraught with uncertainty as the yuan faces pressure along with the stock market, leading to concerns about potential repercussions on the broader economy.

The shifting dynamics in global trade relationships have prompted investors to reassess their strategies, particularly in light of the ongoing geopolitical strife. Analysts suggest that the ramifications of a renewed trade conflict could be far-reaching, affecting not only currency valuations but also investor confidence in the Chinese market.

With the yuan's stability under scrutiny, many are closely monitoring government responses and potential policy adjustments that may arise in the wake of these tensions. The stakes are high, as both nations navigate a complex landscape of tariffs, trade agreements, and economic policies that could redefine their economic futures. Investors are urged to remain vigilant as developments unfold in this critical economic battleground.

MORE NEWS

January 29, 2026 - 02:56

Federal Reserve Holds Steady on Interest Rates Amid Internal DebateIn a widely anticipated move, the Federal Reserve announced Wednesday that it will leave its benchmark interest rate unchanged. This decision follows three consecutive rate cuts in the latter half...

January 28, 2026 - 02:42

Hanmi Financial Q4 Earnings Call HighlightsHanmi Financial Corporation recently detailed its financial results for the fourth quarter and full year of 2025. While the company reported a slight decrease in fourth-quarter earnings, primarily...

January 27, 2026 - 23:32

American Airlines stock tumbles, Nucor misses Q4 sales estimatesInvestors faced turbulence in the industrial and travel sectors as several major companies reported disappointing quarterly results. Shares of American Airlines fell sharply after the carrier...

January 27, 2026 - 04:03

Finance author-podcaster pivots into wealth services under new RIANicole Lapin, a prominent author and podcast host, is making a strategic leap from financial commentary to direct client services. The founder of Money News Network is now a principal in a newly...