Climate Finance in Southeast Asia: A Growing Frustration

January 27, 2025 - 11:15

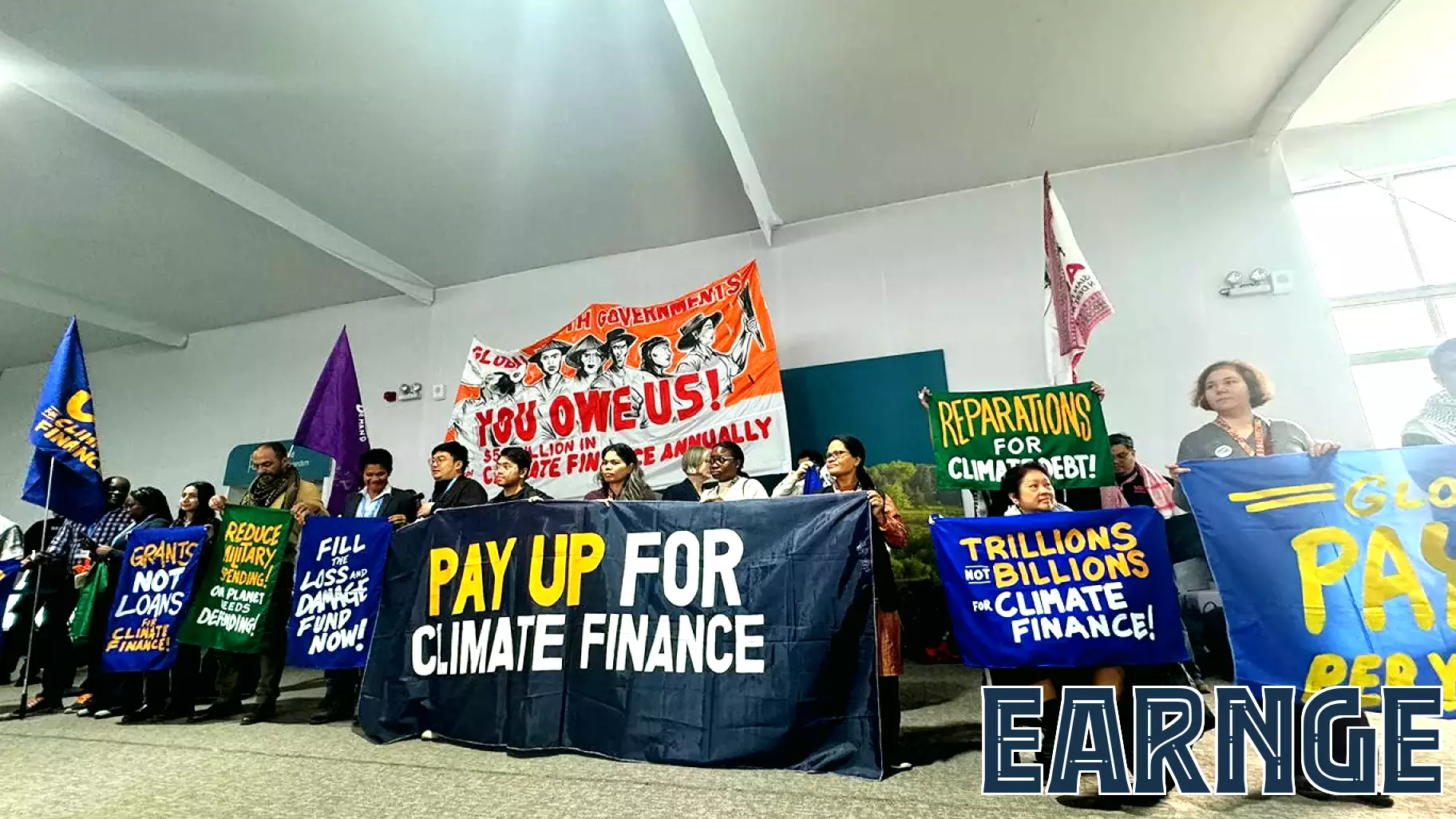

Southeast Asia is experiencing mounting frustration regarding the current state of climate finance. The region, which is particularly vulnerable to the impacts of climate change, has expressed dissatisfaction with the New Collective Quantified Goal on Climate Finance (NCQG). Many stakeholders believe that the NCQG falls short of providing the necessary financial resources to effectively address the climate crisis.

As nations grapple with rising sea levels, extreme weather events, and other climate-related challenges, the demand for adequate funding has never been more urgent. Southeast Asian countries are calling for innovative financing solutions that go beyond traditional donor funding. This includes exploring alternative sources of capital, such as private sector investments and green bonds, to meet their climate adaptation and mitigation needs.

With the stakes higher than ever, regional leaders are urging for a more robust and diversified approach to climate finance that ensures sustainable development and resilience in the face of environmental challenges. The need for action is clear, and the region is seeking collaborative efforts to secure the necessary funding to combat climate change effectively.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...