Concerns Over Trump’s Tariff Policies and Financial Stability

April 13, 2025 - 10:27

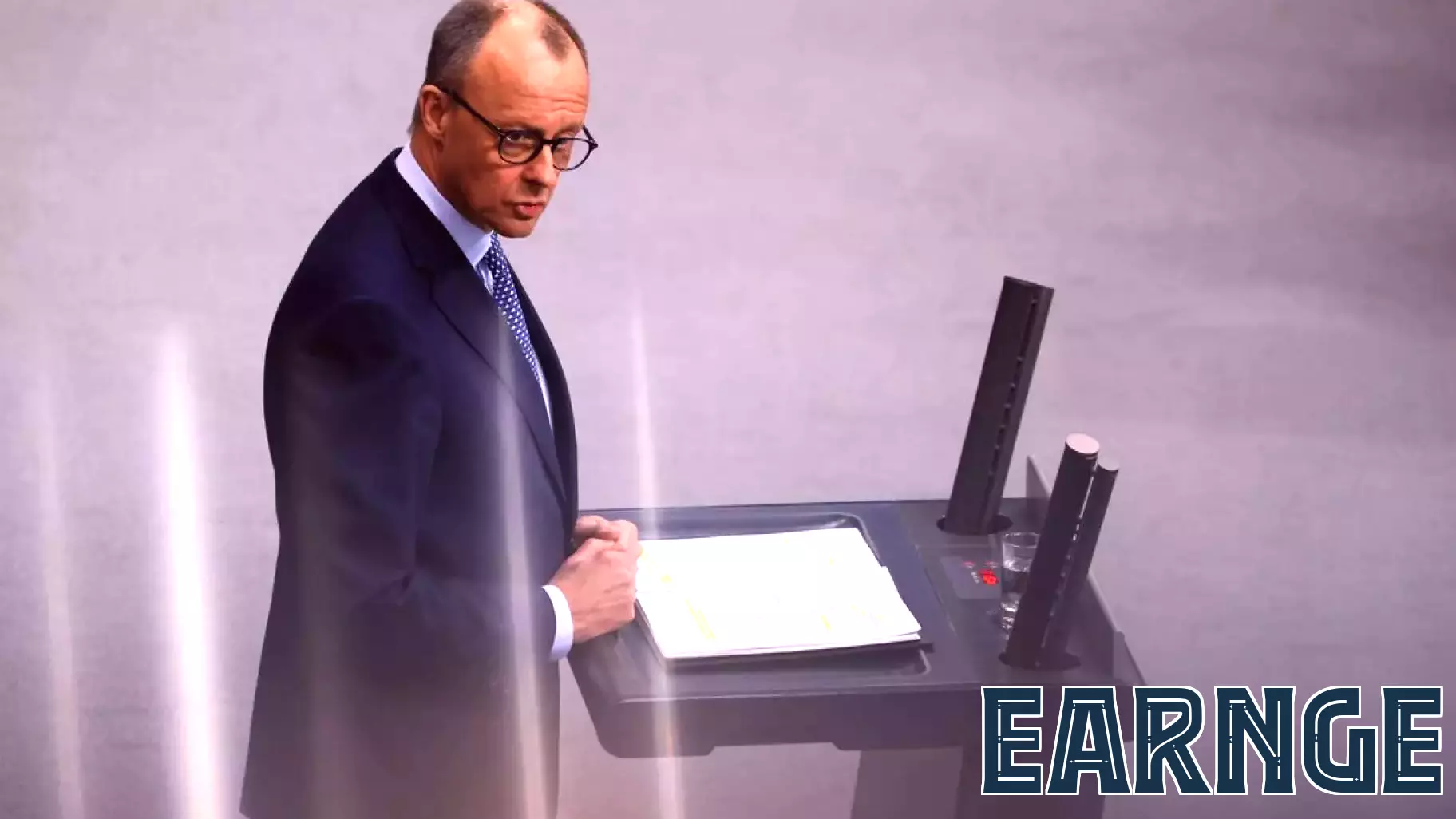

Friedrich Merz, the German Chancellor-in-waiting, has voiced significant concerns regarding the potential economic ramifications of Donald Trump’s tariff policies. He warned that these tariffs could exacerbate the risk of a financial crisis, underscoring the need for a more collaborative approach to international trade. Merz advocates for a US-European free trade agreement, a proposal that has met with resistance from the current US administration.

In his remarks, Merz highlighted the interconnectedness of global economies and the importance of maintaining open trade channels to foster economic stability. He believes that reducing trade barriers between the United States and Europe could mitigate the adverse effects of protectionist measures and promote mutual growth.

As tensions rise over trade policies, the call for a stronger transatlantic partnership becomes increasingly relevant. Merz’s stance reflects a broader concern among European leaders about the impact of unilateral tariffs on global economic stability and cooperation.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...