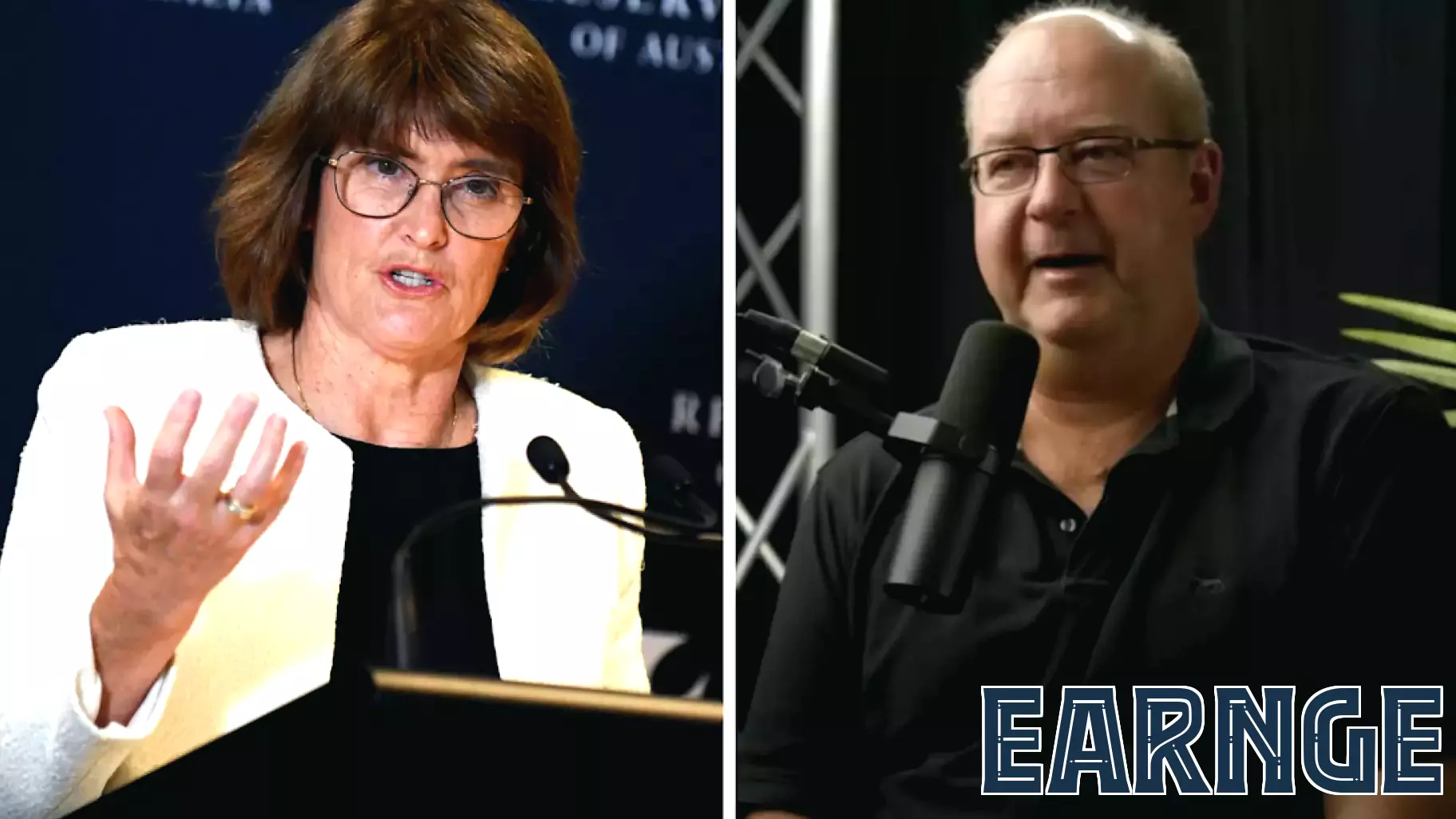

Economist Urges RBA to Lower Interest Rates to 3.5% Soon

June 9, 2025 - 12:11

A prominent economist has recommended that the Reserve Bank of Australia (RBA) reduce interest rates to 3.5% in the upcoming month of July. This bold prediction comes amid ongoing discussions about the economic landscape and the challenges faced by consumers and businesses alike. The economist argues that a rate cut is essential to stimulate economic growth and provide relief to households struggling with high living costs.

The call for a reduction in rates highlights the pressing need for monetary policy adjustments as inflation pressures continue to impact the economy. Lowering the interest rate could potentially encourage borrowing and spending, which in turn may help boost economic activity. With many Australians feeling the pinch from rising expenses, the economist asserts that immediate action is necessary, stating, "There is no need to wait."

As the RBA approaches its next meeting, the implications of this recommendation will be closely monitored by market analysts and policymakers alike.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...