Impact of Trump's Tariffs on Various Industries

April 20, 2025 - 17:21

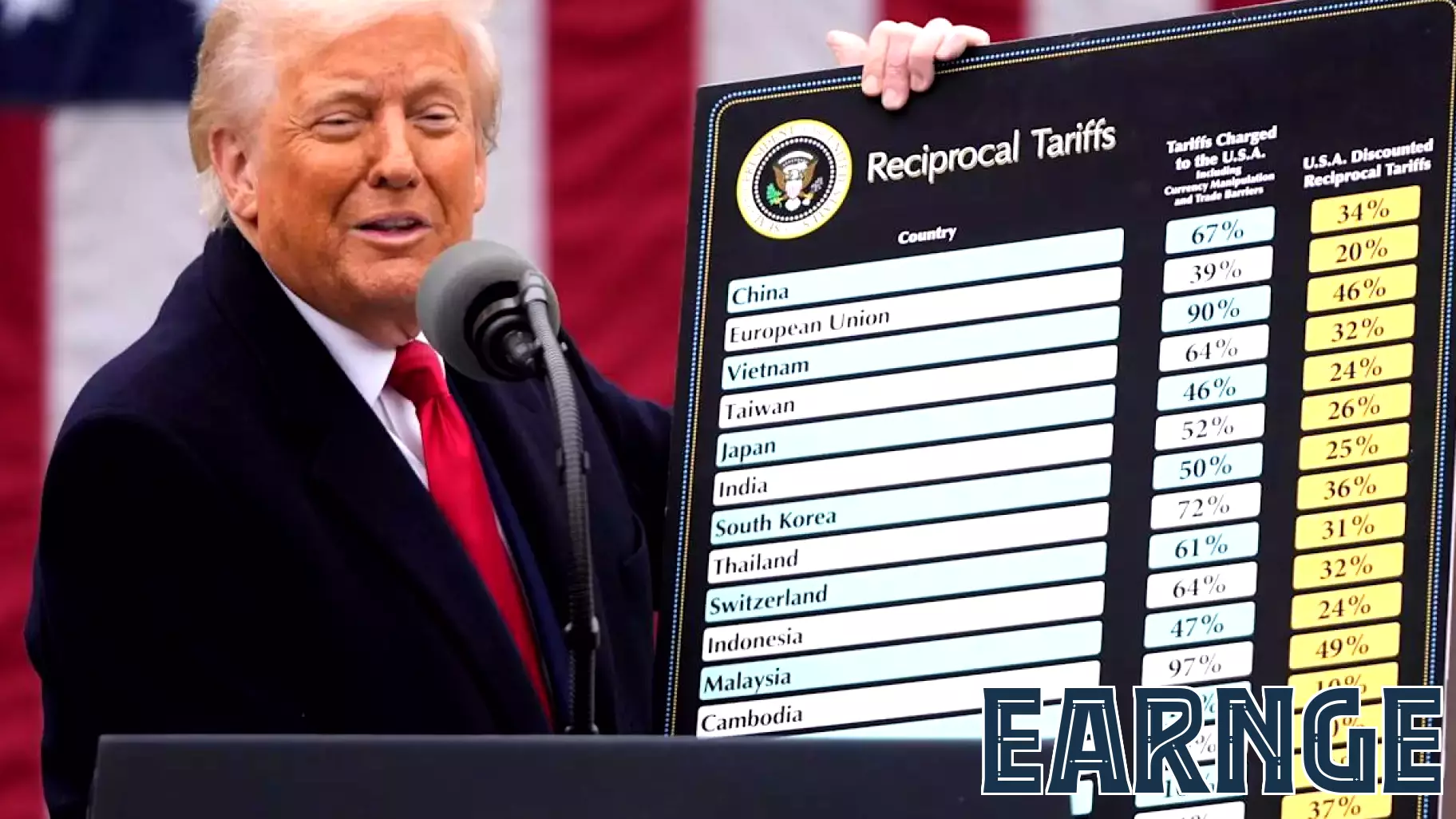

The ongoing tariffs imposed by the Trump administration are creating significant ripples across multiple sectors in the United States. Beauty brands, local markets in Chinatown, and gaming companies are among those bracing for the financial fallout.

Beauty brands, which often rely on imported materials, are facing increased costs that could lead to higher prices for consumers. The potential for reduced profit margins looms large as companies navigate these new economic challenges.

Chinatown neighborhood markets, known for their diverse offerings, are also feeling the strain. Many of these small businesses depend on affordable imports to maintain competitive pricing. The tariffs threaten to disrupt their supply chains, potentially leading to price hikes that could alienate loyal customers.

Meanwhile, gaming companies are assessing the impact on their production costs, as many components are sourced internationally. The uncertainty surrounding tariffs could delay product launches and affect overall profitability.

As these industries adapt to the shifting economic landscape, the full extent of the tariffs' impact remains to be seen.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...