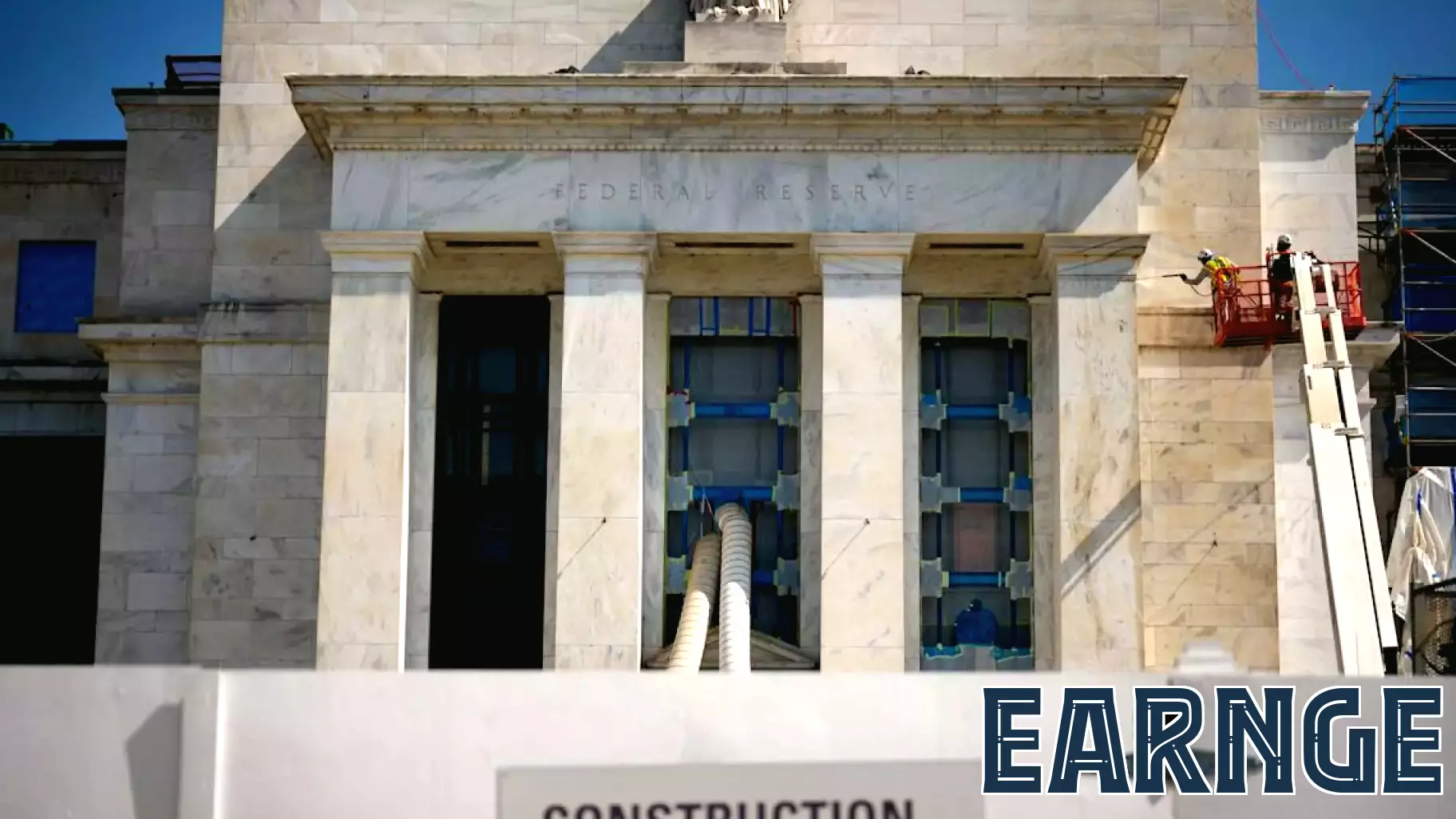

Investors Await Federal Reserve Decision and Big Tech Earnings

July 30, 2025 - 20:29

In a cautious trading session, major U.S. stock indices experienced a decline as investors focused on the upcoming Federal Reserve interest rate decision and the impending earnings reports from leading technology companies. The Dow Jones Industrial Average, S&P 500, and Nasdaq all slipped, reflecting market uncertainty as traders weighed the potential implications of the Fed's monetary policy.

With the central bank holding interest rates steady for the time being, market participants are keenly anticipating any hints regarding future rate adjustments. The Fed's stance is crucial, especially amid ongoing concerns about inflation and economic growth.

Additionally, eyes are on tech giants Microsoft and Meta as they prepare to release their quarterly earnings. These results are expected to provide insight into the health of the tech sector and overall market sentiment. As investors navigate these pivotal events, volatility is likely to persist, keeping market dynamics in a state of flux.

MORE NEWS

February 14, 2026 - 20:05

Service milestones in FebruaryClemson University recently paused to recognize and celebrate the profound contributions of its faculty and staff members who reached significant service milestones in February. The institution...

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...