Monroe Board of Finance Approves Budget for Voter Consideration

April 19, 2025 - 17:45

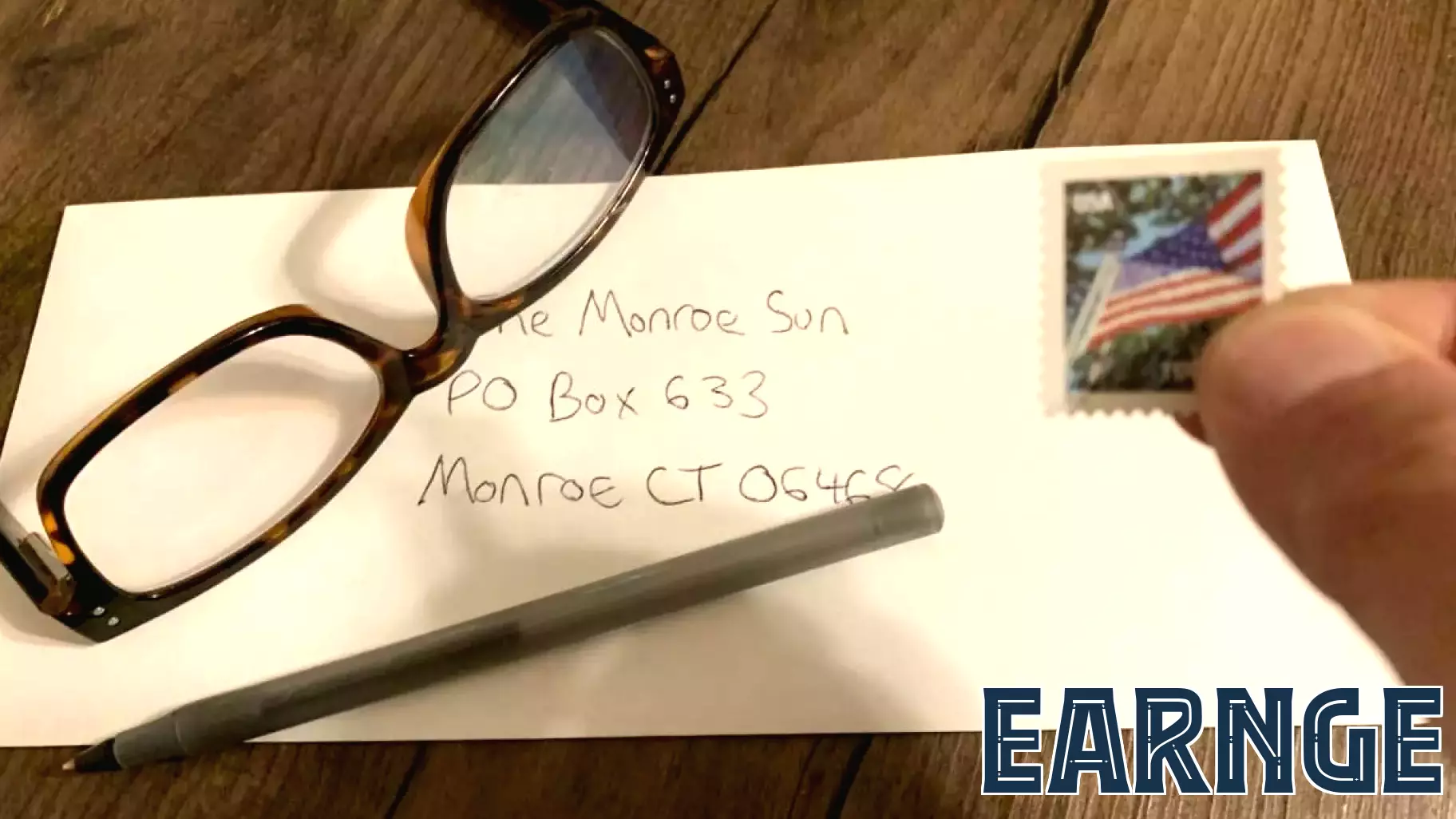

The Monroe Board of Finance has successfully reached a unanimous agreement on the proposed budget for the 2025-2026 fiscal year. Chairwoman Rebecca O'Donnell announced that every line item was approved, marking a significant milestone for the town. This budget is poised to serve as a solid foundation for continued growth, transparency, and improved services for all residents of Monroe.

O'Donnell expressed confidence in the budget, highlighting the collaborative efforts of the board members in crafting a financial plan that addresses the community's needs. The approved budget will now be presented to voters, who will have the opportunity to weigh in on the town's financial future.

The board's commitment to transparency and community engagement is evident in this process, as they aim to ensure that residents feel informed and involved in the decision-making that affects their lives. As the town prepares for the upcoming vote, the Board of Finance is optimistic about the positive impact this budget will have on Monroe's development and services.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...