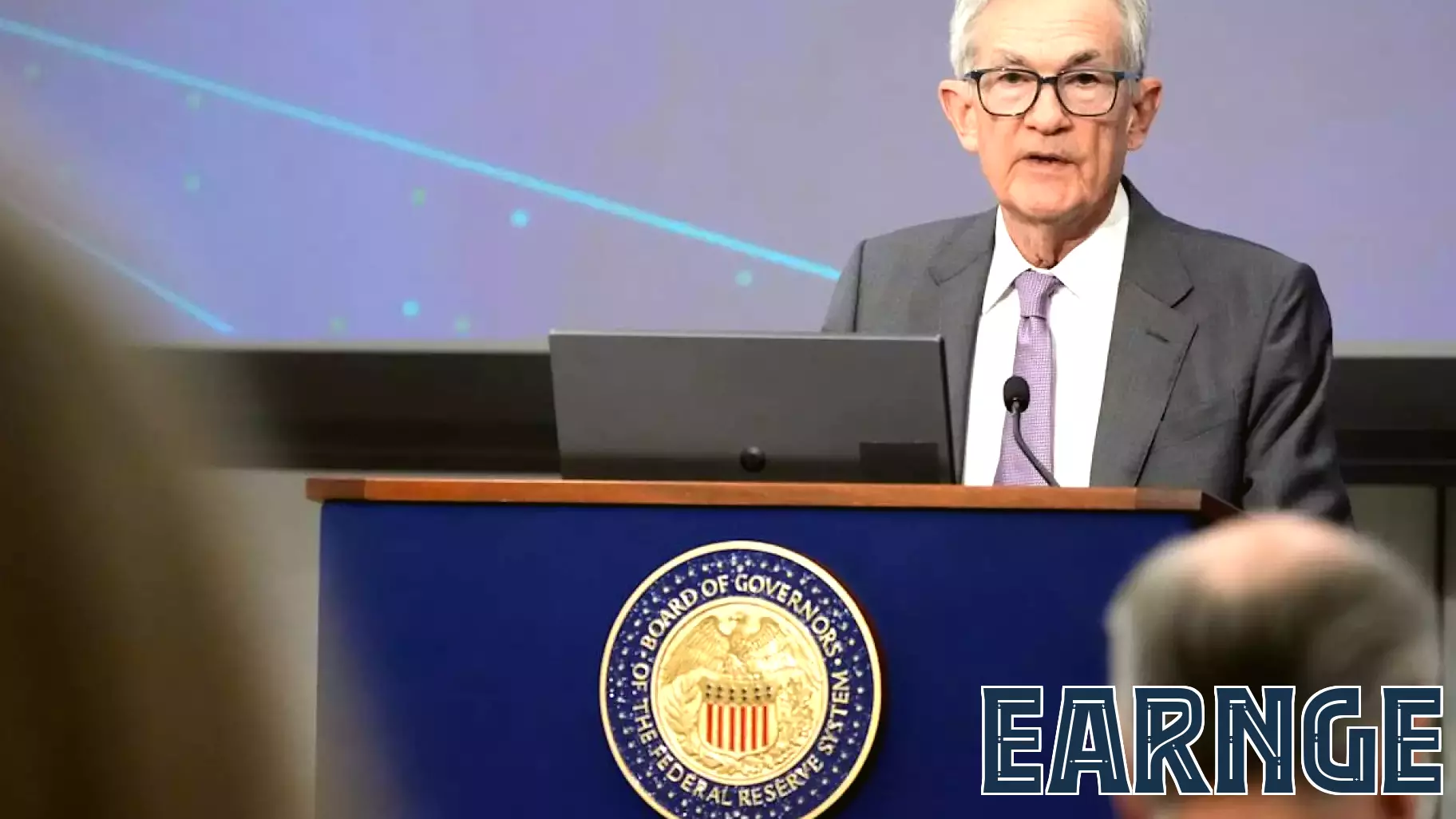

Powell Provides Insights on the Fed's Interest Rate Decision and Future Projections

June 19, 2025 - 02:45

In a highly anticipated press conference, Federal Reserve Chair Jerome Powell addressed the media following the central bank's recent interest rate decision. During the briefing, Powell elaborated on the factors influencing the Fed's choice to maintain or adjust interest rates, emphasizing the importance of inflation trends and economic growth indicators.

Powell also discussed the "dot-plot," a tool used by the Federal Reserve to convey the outlook of its policymakers regarding future interest rate changes. He highlighted the varying perspectives among committee members, which reflect differing assessments of economic conditions and inflationary pressures. The dot-plot serves as a visual representation of these projections, offering insights into the Fed's anticipated monetary policy trajectory.

As inflation remains a key concern, Powell reiterated the Fed's commitment to achieving its dual mandate of price stability and maximum employment. The press conference provided a platform for Powell to clarify the Fed's strategy moving forward, addressing both current economic challenges and the potential for future rate adjustments.

MORE NEWS

February 14, 2026 - 11:35

Robinhood Chain Launch Tests New Growth Story For Tokenized AssetsRobinhood has taken a significant step into the future of finance with the public debut of its new blockchain network. Dubbed Robinhood Chain, this Ethereum-based Layer 2 network is designed to...

February 13, 2026 - 22:53

Stablecoins Explained: Bridging Digital Assets and Traditional FinanceA leading expert from Wharton is shedding light on stablecoins, digital assets designed to bridge the volatile world of cryptocurrency with the stability of traditional finance. These tokens,...

February 13, 2026 - 01:51

Hamilton Lane’s Hartley RogersDespite a period of regional uncertainty, Israel continues to assert itself as a significant and resilient hub for global private market investment. This perspective comes from Hartley Rogers,...

February 12, 2026 - 10:24

ASX Penny Stocks To Watch In February 2026The Australian stock market is navigating a period of cautious optimism, with shares hovering just above flat following a stronger-than-expected U.S. jobs report and recent advances past the...